The tax reform legislation signed into law on December 22, 2017, significantly changes the landscape for individuals beginning January 1, 2018, and continuing through 2025, when many of the individual provisions are set to expire without further Congressional action. For many taxpayers, the changes made by the legislation present a host of tax planning challenges and opportunities going forward.

Due to the elimination or limitation on itemized deductions, and the elimination of personal exemptions, a key consideration in planning for 2018 and future years is to first look at ways to lower your taxable income. You should thus consider maximizing all pre-tax contribution opportunities such as your 401(k), maximizing deductible’ IRA contributions, and consider investing in state and municipal bonds (whose interest is exempt from federal tax).

Also, despite the headlines, it will remain important for you to keep track of your medical expenses, mortgage interest, property and state income or sales tax payments and charitable contributions made during 2018 due to the new restrictions on itemized deductions.

Highlighted below are some of the more significant changes made by the reform legislation and possible challenges and opportunities to lower your tax bill for 2018 and beyond.

Lower Individual Tax Rates – The legislation creates lower individual income tax brackets of 10%, 12%, 22%, 24%, 32%, 35%, and lowers the top rate from 39.6% to 37%, respectively. (The pre-reform rates in effect before 2018 would be restored in 2026, i.e., 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%, respectively).

Modification of the Alternative Minimum Tax (AMT) – The legislation retains the AMT for individuals but increases the exemption amount and phase out thresholds so fewer people will pay it. From 2018 through 2025, a higher AMT exemption will apply to income, beginning with $109,400 for joint filers and $70,300 for other taxpayers in 2018. The exemption will begin to phase out at $1 million for joint filers and $500,000 for other taxpayers. These thresholds will be adjusted for inflation annually.

Increase in the Standard Deduction – For 2018 through 2025, the standard deduction increases significantly from $12,700 in 2017 to $24,000 for joint filers, from $9,350 to $18,000 for heads of households, and from $6,350 to $12,000 for singles. These amounts will be adjusted for inflation annually. Since you can claim the higher of the standard deduction or itemized deductions, you will want to closely compare the two methods as you may now benefit from a higher standard deduction given the many changes to itemized deductions.

Elimination of Personal Exemptions – In exchange for lower tax rates and an increase in the standard deduction, personal exemptions no longer may be claimed for tax years 2018 through 2025.

Child and Dependent Credits – For tax years 2018 through 2025, the reform legislation increases the value of the child tax credit to $2,000 per child under 17 from $1,000. As much as $1,400 of the credit will be refundable, thus allowing recipients to benefit even if they don’t owe taxes. You will need to provide your child’s Social Security number to claim the refundable portion through 2025. The refundable portion of the credit will be indexed for inflation. The legislation also expands eligibility for the credit by increasing the phase out threshold to $400,000 of adjusted gross income for joint filers (up from $110,000 under pre-reform law), with a threshold for all other filers set at $200,000. A $500 nonrefundable credit for dependents other than qualifying children will be available through 2025 (and no Social Security number is required).

$10,000 Cap on State and Local Tax Deduction – In a significant departure from prior law, the legislation will allow individuals to deduct no more than $10,000 of any combination of the following taxes – state and local income taxes, state and local property taxes, and sales taxes – for tax years 2018 through 2025. This overall limitation may result in the enhanced standard deduction yielding a larger deduction against your adjusted gross income and thus a lower tax bill.

Limits on Mortgage Interest Deduction – The tax reform act reduces the amount of mortgage indebtedness on which taxpayers may deduct interest to $750,000 for mortgages or HELOC’s incurred after December 15, 2017. (The $1 million limitation remains for older mortgages). Interest on your principal residence and a second home are deductible. Importantly, beginning in 2018 interest on home equity indebtedness, not used to improve the residence, is no longer deductible, regardless of when it was incurred. These rules apply through 2025.

Medical Expense Deduction – All individuals may deduct medical expenses for 2018 if the expenses exceed 7.5% of adjusted gross income, regardless of age. However, the AGI threshold returns to 10% of adjusted gross income in 2019 for all taxpayers, regardless of age. Again, you will need to review whether claiming such expenses, when combined with other allowable itemized deductions, yields a higher deduction than the standard deduction.

Charitable Contributions – For tax years 2018 through 2025, the legislation increases the AGI limitation on cash contributions from 50% to 60%, thus effectively allowing for an increased deduction. However, the reform act permanently repeals the 80% deduction for contributions made for university athletic seating rights, effective for contributions made after 2017.

Moving Expense Deduction – The deduction for moving expenses is eliminated for tax years 2018 through 2025 except for individuals who are active duty members of the United States Armed Forces.

Elimination of Miscellaneous Itemized Deductions (including Unreimbursed Employee Business Expenses) – The reform act eliminates the deduction for miscellaneous itemized deductions for tax years 2018 through 2025. Thus, deductions subject to the 2% floor of adjusted gross income for costs related to the production or collection of income such as appraisal fees, investment fees, and safety deposit box rentals are not deductible. Importantly, expenses related to employment, such as uniforms, union dues, professional society dues, cell phone, computer used for work, and job-hunting expenses also are not deductible. Employees who incur significant unreimbursed business expenses may want to ask their employer about adjusting their compensation or establish an accountable expense reimbursement plan that would allow the employer to reimburse the employee tax-free while also entitling the employer to a deduction against their business income.

Alimony Deduction – The tax legislation repeals the above-the-line deduction for alimony paid for divorces or separations executed after December 31, 2018. After that date, alimony payments will not be included in the recipient’s income and the payments no longer will be deductible by the payor. If you are currently contemplating divorce or separation, a careful review of the effects of the new law should be undertaken to determine the economic effects on your tax situation and timing of any agreements.

We can run a detailed tax projection to gauge the impact that the changes will have and to prepare you before yearend; there will be a minimum fee charged for these consulting services that will depend on your individual tax profile. Please contact us at your earliest convenience to discuss your personal tax and financial situation.

The Tax Cuts and Jobs Act (TCJA) provides a valuable new tax break to noncorporate owners of pass-through entities: a deduction for a portion of qualified business income (QBI). The deduction generally applies to income from sole proprietorships, partnerships, S corporations and, typically, limited liability companies (LLCs). It can equal as much as 20% of QBI. But once taxable income exceeds $315,000 for married couples filing jointly or $157,500 for other filers, a wage limit begins to phase in.

The Tax Cuts and Jobs Act (TCJA) provides a valuable new tax break to noncorporate owners of pass-through entities: a deduction for a portion of qualified business income (QBI). The deduction generally applies to income from sole proprietorships, partnerships, S corporations and, typically, limited liability companies (LLCs). It can equal as much as 20% of QBI. But once taxable income exceeds $315,000 for married couples filing jointly or $157,500 for other filers, a wage limit begins to phase in.

Technology is tricky. Much of today’s software is engineered so well that it will perform adequately for years. But new and better features are being created all the time. And if you’re not getting as much out of your financial data as your competitors are, you could be at a disadvantage.

Technology is tricky. Much of today’s software is engineered so well that it will perform adequately for years. But new and better features are being created all the time. And if you’re not getting as much out of your financial data as your competitors are, you could be at a disadvantage. Because donations to charity of cash or property generally are tax deductible (if you itemize), it only seems logical that the donation of something even more valuable to you — your time — would also be deductible. Unfortunately, that’s not the case.

Because donations to charity of cash or property generally are tax deductible (if you itemize), it only seems logical that the donation of something even more valuable to you — your time — would also be deductible. Unfortunately, that’s not the case. On one level, every company’s inventory is a carefully curated collection of inanimate objects ready for sale. But, on another, it can be a confounding, slippery and unpredictable creature that can shrink too small or grow too big — despite your best efforts to keep it contained. If your inventory has been getting the better of you lately, don’t give up on showing it who’s boss.

On one level, every company’s inventory is a carefully curated collection of inanimate objects ready for sale. But, on another, it can be a confounding, slippery and unpredictable creature that can shrink too small or grow too big — despite your best efforts to keep it contained. If your inventory has been getting the better of you lately, don’t give up on showing it who’s boss. “Going green” at home — whether it’s your principal residence or a second home — can reduce your tax bill in addition to your energy bill, all while helping the environment, too. The catch is that, to reap all three benefits, you need to buy and install certain types of renewable energy equipment in the home.

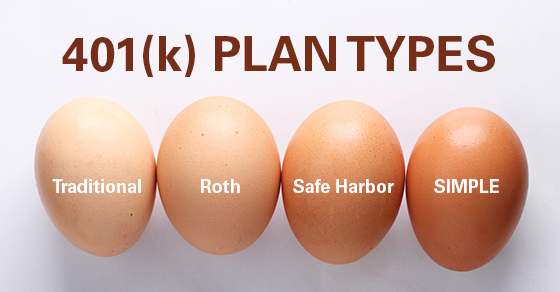

“Going green” at home — whether it’s your principal residence or a second home — can reduce your tax bill in addition to your energy bill, all while helping the environment, too. The catch is that, to reap all three benefits, you need to buy and install certain types of renewable energy equipment in the home. By and large, today’s employees expect employers to offer a tax-advantaged retirement plan. A 401(k) is an obvious choice to consider, but you may not be aware that there are a variety of types to choose from. Let’s check out some of the most popular options:

By and large, today’s employees expect employers to offer a tax-advantaged retirement plan. A 401(k) is an obvious choice to consider, but you may not be aware that there are a variety of types to choose from. Let’s check out some of the most popular options: